Go paper-free

Amend paper-free preferences for your statements and communications.

Whether this is your first house purchase, a move to a new home or you have remortgaged to us from another lender, we want to say a huge ‘thank you’ for letting us be part of your journey and welcome you to 'The Halifax'.

This short 2-minute video outlines all the information we think you need to know now your mortgage has completed.

We want to make sure you know what to expect from your first payment, particularly because this payment is often different to future payments.

The working day after your completion date, we will send you a text message confirming how much your first payment amount will be and the date it’s due. We will also send you a letter to confirm this payment, along with all future payments. You should receive this letter in the post within 10 days of completion.

Your first payment may be more than you expect. This is because as soon as your mortgage starts, interest is charged daily, and this interest is added to your first payment amount.

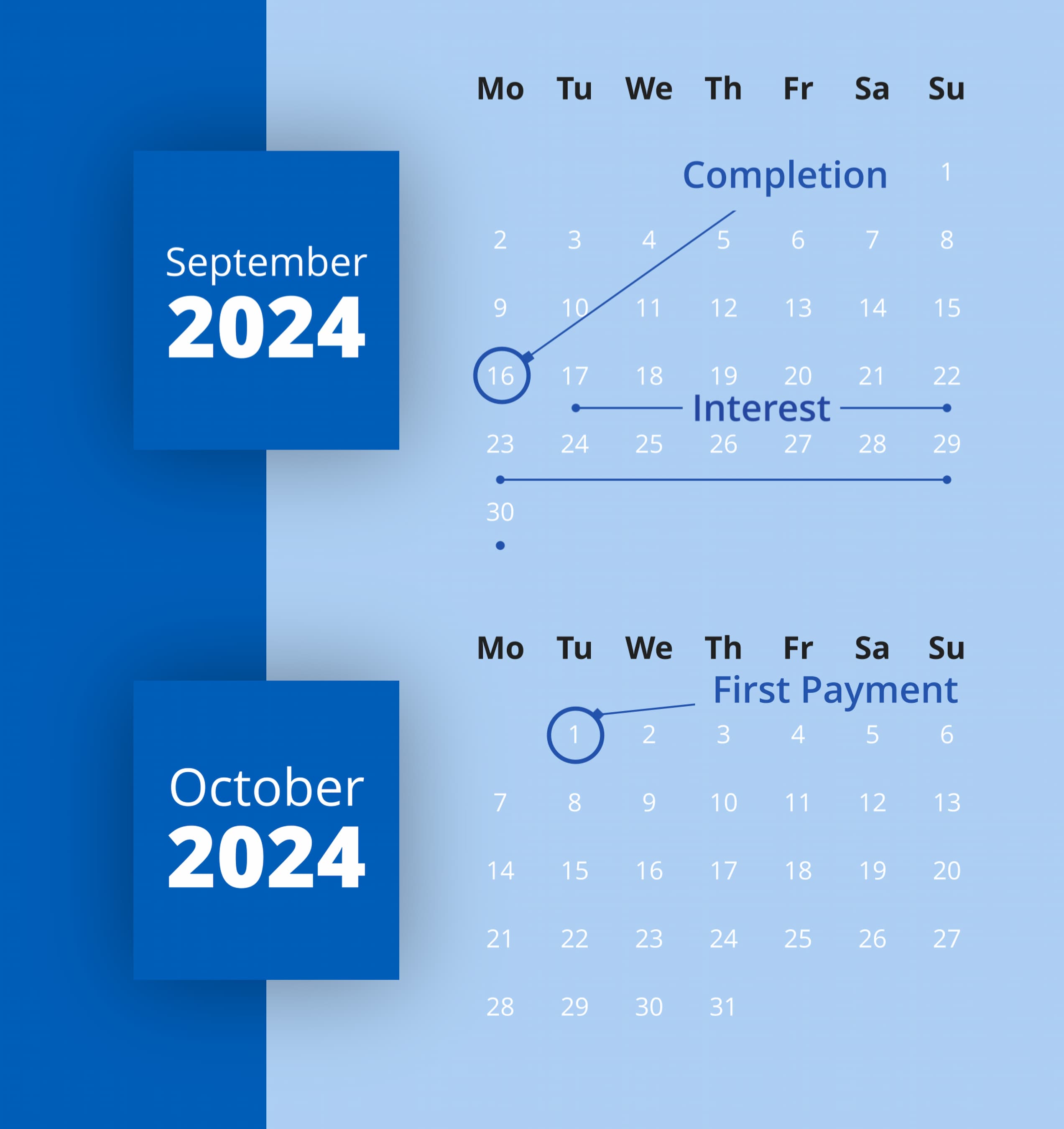

For example, if your mortgage completes on the 16th of September and your payment date is the 1st of the month, your first payment will include your normal agreed monthly payment amount plus the additional interest built up from 16th September to the 1st October.

This only happens with your first payment; all future payments will be the amount shown on your confirmation letter.

If you are on a tracker or variable product and interest rates change, we’ll always let you know any impact to your monthly payments in advance.

If your mortgage was already with Halifax, your first monthly payment could still be different in the following scenarios: