Go paper-free

Amend paper-free preferences for your statements and communications.

How you became a landlord doesn’t matter but how you handle the responsibilities that come with your new role does.

Whether you’ve bought a property to provide an income for your retirement or you’ve inherited a house and have become a landlord by accident rather than choice - it makes no difference to your obligations.

Being a landlord can be a satisfying experience, both financially and personally, but there are also risks.

So, if you’re looking to protect your property, your tenants and your reputation, this checklist is the key to unlocking your success as a landlord.

Did you know that hermit crabs tuck themselves into abandoned shells to protect themselves from predators? OK, so it’s not quite the same, but your tenants are effectively using your home as their shell. To avoid getting ‘crabby' with your tenants, you should make sure that you get to know the new residents before agreeing to a tenancy agreement.

Tip 1: Tenant referencing

One of the easiest and cheapest ways to make sure that your tenant is reliable is to carry out tenant referencing. This tends to involve identity and credit checks, as well as seeking employment and previous landlord references.

Tip 2: ‘Right-to-Rent’ checks

The Immigration Act 2014 states that landlords in England must check whether new tenants have the ‘Right-to-Rent’ before starting a tenancy. You’ll need to check immigration documents and keep copies. These checks are important, and failure to comply could result in a fine of up to £3,000 per illegal tenant. And what’s more, you must repeat these checks regularly if a tenant has a time limit on their ‘Right-to-Rent’.

Note: The ‘Right-to-Rent’ rules do not currently apply in Wales, Scotland and Northern Ireland.

Tip 3: Trust your instincts

You can do all the background checks in the world, but sometimes your instincts are the best judge of character. A tenant might look great on paper but could fail to live up to expectations when you meet. Check out our tips on ‘How to avoid problem tenants’ and remember, trust your research but do not ignore your gut.

The way to ensure that you protect yourself and your reputation is to set clear boundaries from the outset and to make sure that your tenants understand the consequences of their actions.

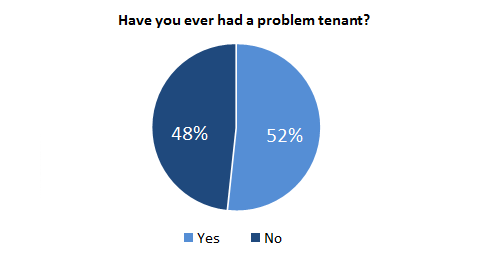

The importance of this is highlighted by the fact that over half of landlords have experienced problems with a tenant at some point.

Source: Landlord Survey 2017, HomeLet (PDF, 960 KB)

Here are some ways that you can protect yourself as a landlord:

Tenancy Deposit Protection (TDP)

Tenancy Deposit Protection schemes are companies approved by the government. There are three government-backed tenancy deposit schemes that you can choose to use in England and Wales. These are:

Note: If you live in Scotland or Northern Ireland there are different TDP schemes available.

At first, deposit protection schemes appear to be designed with a tenant’s best interests in mind, but there are many benefits for landlords too.

Of course, you may decide not to take a deposit from your tenants, though it’s recommended to give you some financial security. Having safeguards in place for the deposit means that if your tenants cause damage to your property or take something that belongs to you, you’re not left to foot the bill.

And a TDP scheme provides further protection by facilitating the process of dealing with deductions and disputes when tenants do turn bad. Thankfully, most tenants won’t cause any problems, in which case, a TDP company just returns the deposit on your behalf.

Rent guarantee insurance

In times of economic uncertainty, even the most reliable tenants may hit tough times and find themselves unable to afford the rent. Having a rent guarantee policy in place can protect you from being out of pocket as a landlord if tenants are unable to meet their rental commitments.

Landlord insurance

Perhaps the most important way to protect yourself as a landlord is to make sure you have the right insurance cover in place. Standard home insurance won’t provide you with all the protection you need, and you may even find that your policy is invalid if you ever need to claim. This is because there are risks that come with renting a property that home insurance policies aren’t designed to cover.

The peace of mind that comes from having the safety net of a landlord insurance policy in place is priceless. Protecting your property ultimately means that you’re defending your future profits too, so it’s important not just from an emotional but a financial perspective as well.

The types of cover that your landlord insurance can provide include:

You can also choose to add optional extras on to your policy including accidental damage insurance, or legal expenses which will cover any substantial court costs if you need to go down the legal route to get rid of any problem tenants or squatters.

If you’re looking for flexible landlord cover to protect your property and your tenants, then you can get a quick and easy online quote right now. It could take just minutes to put your mind at rest that you have the right insurance in place.

Build a good relationship with tenants

The simplest way to protect your interests as a landlord is to take time to listen to tenants. By hearing what they have to say and dealing with problems promptly, you'll build up trust and find out what is going on before it becomes a major issue. This can be invaluable, saving you time, money and hassle in the long run.

Without complying with the necessary legal requirements of a landlord, you won’t have a stable foundation on which to build your property portfolio. Even if you’re happy just renting out the one property, there are still several certificates that you're required by law to give your tenants. These which form the building blocks of your relationship enabling trust and respect to grow.

Here are some checks and certificates that you’re required by law to produce.

Safety certificate

As a landlord, it's up to you to make sure that all gas equipment and appliances pass an annual safety check. This check needs to be carried out by a Gas Safe registered engineer. You must give your tenants a copy of the gas safety check record as soon as they move in or within 28 days of the check being completed.

Energy Performance Certificate (EPC)

Energy Performance Certificates contain information about how much energy a property uses and how much this typically costs. It also offers advice on how to reduce energy consumption to save money. The EPC will rate your property's energy efficiency from A (most efficient) to G (least efficient).

Don’t avoid getting an EPC if you’re worried that your property isn’t as efficient as it could be. It’s a legal requirement for any properties being built, sold, or rented. The EPC will also be valid for ten years so once you've sorted the certificate out, you won't have to worry again for a while.

To get your EPC, you'll need to find an accredited assessor to review your property and provide the certificate. You can see details of assessors in your area here:

Note: In Scotland, your EPC must be displayed somewhere within the property which can be easily seen by your tenants.

Electrical certificate

Don’t leave yourself exposed to unnecessary financial risks, including substantial fines and invalidated insurance, by not meeting your electrical safety obligations. And being out of pocket isn’t the worse that could happen either. By failing to ensure that your property’s electrical system is safe and in full working order, you could be putting your tenants’ lives at risk.

Get a registered electrician to give all electrical appliances, sockets and light fittings a thumbs up before you rent out your property.

Note: There isn’t currently a requirement for electrical checks to be performed regularly unless your property is a House in Multiple Occupation (HMO), in which case you need an inspection every five years. For reassurance and your tenants’ safety, it makes sense to get an electrician to check your property every couple of years.

Fire safety

You won’t get a certificate for this one, but by law, you’ll need to install smoke detectors and carbon monoxide alarms on every floor in your property. You’ll also be responsible for checking that they work. Failure to do so could result in a £5,000 civil penalty.

Note: If your property is an HMO, you’ll need to have a proper risk assessment to make sure your property complies with fire safety regulations.

You’ve vetted your tenants, understood the risks of being a landlord and completed all that’s legally required of you. Now you can sit back and let the rent roll in, right? Wrong. There are many more responsibilities that you’ll have to face up to as a reliable landlord. It’s all worth it though as being a landlord can be a lucrative and secure long-term way of making money.

Make an inventory

Don’t fall into the trap of thinking that because your property is not fully furnished, you don’t need to make an inventory. The truth is, the inventory is more than just the furnishings, it’s about what condition your property is in when your tenants move in. The cleanliness, the condition of internally-decorated walls, any damage to fixtures and fittings – these are all things you want to check before and after a tenant has occupied your property.

Note: If you’re leaving soft furnishings in your property they must meet the relevant safety regulations.

Fulfil your maintenance and repair obligations

If the shower stops working on a Saturday morning or the boiler breaks in the middle of the night, you can expect a call from an anxious tenant. As inconvenient as it can be at times, try your best to resolve any issues or faults as soon as possible. It’ll show that you’re a responsible landlord and go a long way in reinforcing your good relationship.

Remember though that you need to agree a time that suits your tenants to enter your property and carry out any necessary repairs. Although you own the property, it's illegal for you to let yourself in. Without giving your tenants at least 24 hours' notice before you turn up, your tenants could accuse you of harassment which could result in prosecution.

Give your tenant a copy of the ‘How to rent checklist.'

You can either give your tenant a physical copy of the ‘How to rent checklist (PDF, 557 KB)’, or you could email it to them. At each renewal of the tenancy agreement make sure that you provide the most recent version of the checklist.

Note: You only have to provide a copy of this checklist in England.

In Scotland, you must give your tenants a copy of the Tenant Information Pack.

In Northern Ireland, the Rent Book (PDF, 31 KB) must be given to tenants.

Register with the National Landlords Association (NLA)

Joining the National Landlords Association can help to enhance your credibility. You'll also be able to keep up to date with the latest information and legislation affecting landlords so you can always stay one step ahead of the game. And that’s not all. You’ll also get the opportunity to meet up with other landlords allowing you to share stories and problems with people who have ‘been there done that’.

By accepting and managing the risks and issues that being a landlord can bring, you’ll also get to reap the rewards. Following this checklist will help you get everything in place to prepare you for being a new landlord. The effort will all be worth it in the long run.

Find out more about Landlord Insurance.