Go paper-free

Amend paper-free preferences for your statements and communications.

Let's find a mix that works for you.

Your needs are unique to you. Only you’ll know if it makes sense to save, invest, or to cover both bases.

This information could help.

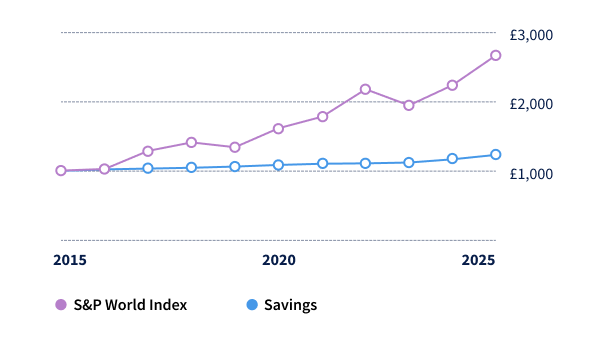

Of course, what’s happened before isn’t a guarantee of what will happen in the future. But it’s interesting all the same to compare the 10-year journey of cash savings and investments.

Savings – MoneyFacts, 12m fixed non ISA rates, January 2025.

Investments – S&P Dow Jones Indices, S&P World Index (GBP). Excludes fees and does not include any dividends or reinvestment.

These figures refer to the past and past performance is not a reliable indicator of future performance. See a data breakdown of the performance in the table here. See a data breakdown.

Halifax Share Dealing Limited. Registered in England and Wales no. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.