Go paper-free

Amend paper-free preferences for your statements and communications.

Inflation measures the rate at which the price of goods and services go up by each year. It can rise and fall, based on supply and demand. We can help you understand what inflation is, how it’s measured, and how it affects you and your money.

Inflation is the increase in the price of goods (like clothes or food) and services (like hairdressing or plumbing) over a period of time.

It’s calculated by taking the cost of something today – such as a pint of milk – and looking at how much it cost this time last year. This comparison is done on a wide variety of items, known as the ‘basket of goods and services’ which the Office for National Statistics then averages.

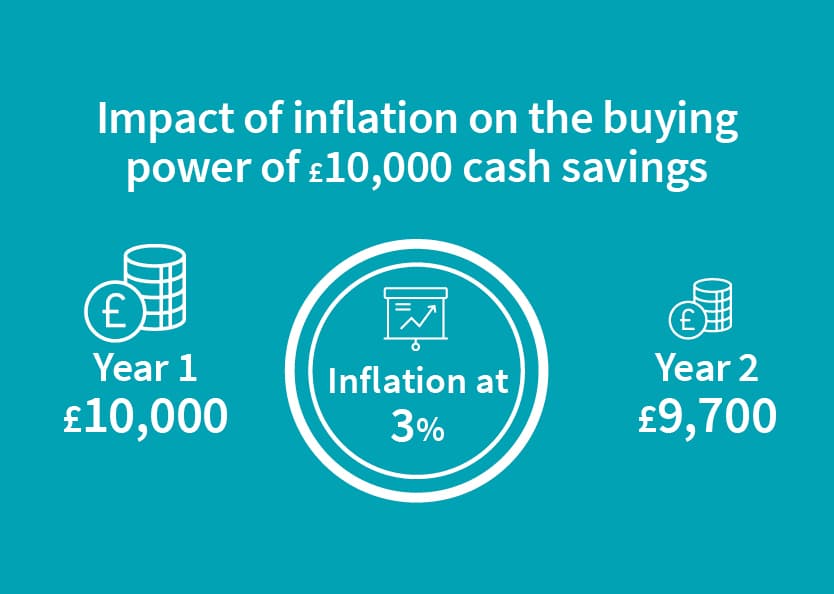

Inflation is expressed as a percentage, based on the increase in prices of the items in the basket. So, if your pint of milk cost £1 last year, and £1.03 this year, inflation has risen by 3%.

The UK’s inflation target is 2% year on year. Controlled inflation can be positive for the economy. But if it jumps quickly, or unpredictably, it can make it difficult for people to know how much to spend, save or invest.

On a daily basis, inflation changes how much money is worth. If there’s a higher inflation rate, your money won’t go as far because things cost more.

This illustration shows how inflation can impact your savings if inflation was at, for example, 3%.

You can find the latest inflation information at Office for National Statistics. It is also worth remembering that the rate of inflation can rise and fall.

When you buy goods and services, you may get less for your money. If prices go up and increase more than the rise in wages, it can have an impact to the cost of living.

To keep the same spending power, wages would need to increase. Some companies may not want to, or be able to do this. If wages did increase, this could cause more inflation if prices need to rise to cover for the cost of the wage increases.

As inflation rises, interest rates may rise too. If this happens, it can make it more expensive for you to borrow.

A rise in inflation can be caused by a wide range of things. It’s most often linked to an increase in demand for products and services or an increase in production costs.

The cost of energy is a key reason why things are getting more expensive. Oil and gas prices increased because energy was in greater demand.

How will inflation affect my cash?

It’s difficult to know, but our inflation calculator can give you an idea. By putting in the amount of cash you have, and adding in the current rate of inflation, we can work out the future buying power of your money. This calculation is based on the inflation rate remaining the same over the next year.

The calculator is an estimate. It does not include interest you could earn over time. The rate of inflation can rise and fall.

For an up-to-date view, visit the Office for National Statistics.

It’s good to make a plan if you are planning on buying a home, travelling the world or starting a family. Whatever your goals, we have tips and guidance to support you.

With so many options available, it’s good to think about your financial goals and work out where best to put your money. We have support and guidance to help you make the right decision.

We have tips and tools to help you with budgeting, borrowing, saving or supporting others.

We’re here for the ups, the downs and everything in between.

Whether you're facing a tough time, or you need help managing your money, we’re here to help.

Halifax is a division of Bank of Scotland plc. Registered in Scotland No. SC327000. Registered Office: The Mound, Edinburgh EH1 1YZ. Bank of Scotland plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 169628. Schroders Personal Wealth is a trading name for Scottish Widows Schroder Personal Wealth Limited.