Go paper-free

Amend paper-free preferences for your statements and communications.

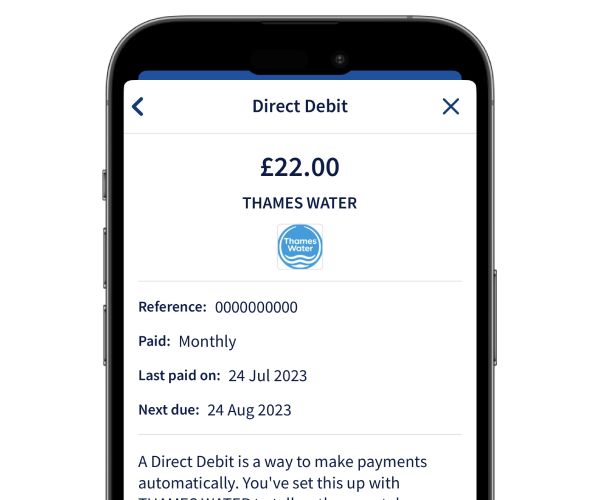

You should always tell the company you’re paying if you cancel a direct debit.

If you cancel a direct debit that’s due in the next 2 days, it may still leave your account.

If you're not registered for Online Banking, you can call us. We also offer a range of other services in your local area.

|

Regular payment type |

What it is |

Used for things like |

See these guides |

|---|---|---|---|

|

Regular payment type Direct Debit |

What it is

|

Used for things like

|

See these guides |

|

Regular payment type Standing order |

What it is

|

Used for things like

|

See these guides |

|

Regular payment type Subscription payment |

What it is

|

Used for things like

|

See these guides View, cancel or block a subscription (app only) |

You don’t need to tell your bank when you set up a direct debit. You create it directly with the company you want to pay.

You can usually do this over the phone, online or through the post. They'll need to know:

The company may ask you to fill in a direct debit form. If you set up the direct debit over the phone or online, you should receive confirmation in writing.

Sometimes you may need to tell the company you're paying about changes to your account. These can include:

It’s important to update your direct debit details if this happens so the payment goes through as normal.

If you set up a new bank account using a switching service, you don't need to do anything. Your direct debits move over to your new account automatically.

To make any other changes, such as changing the payment date, you'll need to contact the company you're paying.

You usually choose the date your direct debit will come out when you set it up.

Bank holidays and weekends

If the payment date falls on a weekend or on a bank holiday, the company will take it on the next working day. There's no need to worry about late payment fees or changing your direct debit date. This happens automatically.