Go paper-free

Amend paper-free preferences for your statements and communications.

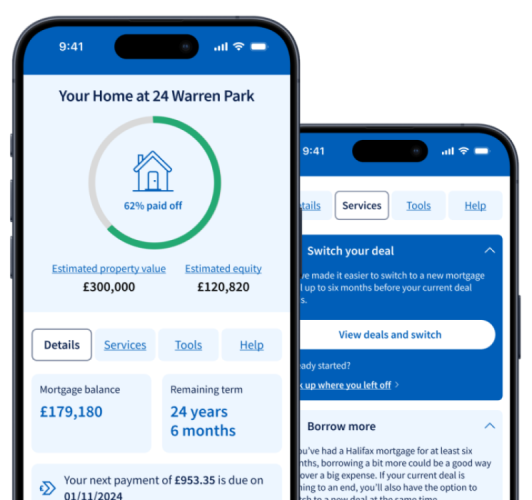

Manage your mortgage all in one place and at the touch of a button.

To view and manage your mortgage, visit HelloHome. You can find it in Online Banking or our Mobile Banking app. If you're not registered for Online Banking, it only takes about five minutes to set things up.

Register for Online or Mobile Banking.

See our FAQs below for help on managing your mortgage.

Your mortgage could be a mix of different repayment methods with different interest rates over different mortgage terms. For example, you could have individual balances for additional borrowing or fees. These are known as sub-accounts. Each sub-account has its own individual monthly payment, which we add together to make up your total monthly mortgage payment.

For repayment mortgages, your monthly payments go towards reducing the amount you owe, as well as paying off the interest.

For interest only mortgages, the overall balance stays the same. But there might be some small differences on certain days or if you have any fees to pay.

If you make any overpayments, we'll apply them across all sub-accounts in the same way we do with your normal monthly payments unless you tell us otherwise.

Your mortgage could be a mix of different repayment methods with different interest rates over different mortgage terms. For example, you could have individual balances for additional borrowing or fees. These are known as sub-accounts. Each sub-account has its own individual monthly payment, which we add together to make up your total monthly mortgage payment.

The majority of our customers will have a sub-account 01, which is their main mortgage, and a sub-account 99, which holds fees. Some customers may also have a sub-account 98 if they have a mortgage account fee.

You’ll be able to find all of your sub-accounts in Online Banking or our mobile app.

Here’s an example of how it works

The interest on your mortgage is calculated either daily or annually. You can find which one applies to your mortgage on your mortgage statement. All product rates listed on our website today are on daily interest.

If you're currently on annual interest and would like to change to daily interest, call us.

Daily interest

This is worked out by charging interest on the amount of your outstanding mortgage on a daily basis, which is then added monthly until you've paid it off. You’ll find more info in your mortgage offer.

Annual interest

This is worked out when interest is added to your account once a year, on the same date, based on your outstanding mortgage balance at the start of the mortgage year. This is known as your mortgage account year.

Your mortgage balance might reduce over the year as you make your monthly payments. But the balance on which interest is charged doesn't change until your mortgage account year starts again.

This was previously charged on new mortgages and is always interest free. If you were charged one, it’ll be shown in sub-account 98 in Online Banking, our Mobile Banking app, or your mortgage statement.

Not registered for Online Banking? It's easy and only takes about five minutes.

Some mortgages have charges for repaying all or part of the mortgage back within a certain time. We call these early repayment charges (ERCs).

To see if any ERCs apply to your mortgage, you can check your mortgage statement or offer, or you can call us.

If you have a hearing or speech impairment, you can contact us using the Relay UK service. There’s more information on the Relay UK help pages. If you’re Deaf and a BSL user, you can use our BSL SignVideo service.

Unless you have a Buy to Let mortgage, you’ll need to ask us if you want to rent out your home. We call this a consent to lease agreement.

Find out how to rent out your home, the conditions that apply, and how to cancel an existing consent to lease agreement.

When moving home, you'll need to apply for a new mortgage. You'll need to call us to find out if you can transfer your existing mortgage deal - known as porting - when you move.

We also have a range of moving home deals available, and might be able to offer you additional borrowing to cover any extra costs for your new property.

We have a range of options for you to make your monthly mortgage payment, including Direct Debit, standing order, cheque, or by speaking to us.

To find out how, visit our Make your monthly mortgage payment page.

Making regular or one-off overpayments to your mortgage goes towards reducing your mortgage balance, meaning you’ll owe less and have less interest to pay.

You can make as many overpayments as you like, but you might have to pay an early repayment charge (ERC) for doing so.

To manage your Direct Debit payment, including changing the date it’s paid, or the account it’s taken from, visit our Change your Direct Debit page.

If you make any overpayments, we'll apply them across all sub-accounts in the same way we do with your normal monthly payments unless you tell us otherwise.

When you make an overpayment, you’d usually put your 14-digit mortgage account number, plus an extra ‘00’ on the end, in the payment reference section. To make an overpayment to a specific sub-account, you need to replace ‘00’ with the two-digit sub-account number in the payment reference field.

For example:

If you’re making an overpayment by phone, you’ll need to speak to us if you’d like to apply your overpayment to a specific sub-account.

An underpayment is where you pay us less than your normal monthly mortgage payment.

You can only make an underpayment if you’ve made an overpayment of the same or larger amount. This is because we’ll use your overpayment balance to cover the amount that won’t be paid.

If you want to make an underpayment to your mortgage, call us.

We’ll use your reduced balance after any overpayments whenever we work out a new monthly payment for you. Once we’ve done that, you’ll need to overpay again before you can underpay.

You’ll need to call us to apply for a payment holiday.

If you think you might not be able to make your monthly mortgage payment, call us as soon as possible or visit our Mortgage support page.

The sooner you get in touch, the sooner we can help.

In most cases, your payments will show on your account within 24 hours. You can find out more about how long different payment types take by selecting these links.

Make your monthly mortgage payment

You can view your payments online or with our Mobile Banking app. If you're not registered for Online Banking yet, it only takes about five minutes to set things up, Register for Online or Mobile Banking.

You can also call us if you prefer.

If your Halifax mortgage deal is coming to an end, you could look to switch to a new deal. Or, you'll be automatically changed onto one of our lender variable rates.

Your new monthly payment will be worked out based on your new rate. We’ll let you know when it’ll change.

You can check your mortage balance and interest rate quickly and easily in Online Banking.

Not registered for Online Banking?

Your mortgage balance will include both debit and credit payments up to the date shown. You can also view and manage your mortgage in one place with HelloHome, which you can find in Online Banking or our Mobile Banking app.

You can repay your mortgage in full at any time, as long as you also pay any early repayment charges (ERCs) that apply.

You’ll need to complete our online form. We’ll then send you a redemption statement, which will show the total amount you need to pay. It’ll include any interest charges, and other fees.

You can also ask for a redemption statement over the phone. Call us.

If you have a hearing or speech impairment, you can contact us using the Relay UK service. There’s more information on the Relay UK help pages. If you’re Deaf and a BSL user, you can use our BSL SignVideo service.

If you do pay off your mortgage in full, make sure your details are up-to-date in case we need to contact you.

Learn more by visting our How do I pay off my mortgage in full? page.

We'll send you a mortgage statement each year on the anniversary of the month you took out your mortgage with us.

It gives you important details about your mortgage, including how much you owe, what interest rates you pay, how much interest we've charged, and the payments you've made each month.

You can find most of the information from your mortgage statement in HelloHome. But if you need to order a duplicate mortgage statement, you can do it in Online Banking:

If you’re on a mobile device, you’ll need to use the internet browser on your phone or tablet, not the Mobile Banking app. Not registered for Online Banking?

You can also fill out our online form or call us to request a statement.

A Certificate of Mortgage Interest shows you how much interest has been charged to your mortgage account during a full UK tax year (April to April). You can use it to help you complete your tax return or annual accounts.

To request a Certificate of Mortgage Interest, sign in to Online Banking, then select:

If you’re on a mobile device, you’ll need to use the internet browser on your phone or tablet, not the Mobile Banking app. Not registered for Online Banking?

You can also fill out our online form or call us.

Where ERCs apply, you can make overpayments of up to 10% of the amount owed as of 01 January.

If you overpay more than 10% over the year, we'll only charge you on the balance you overpay above 10%.

For example, on a mortgage balance of £200,000, you can overpay by up to £20,000 as either a one-off overpayment or regular monthly overpayments in one calendar year.

We can change the overpayment allowance at any time, so check before making any payments.

If ERCs don’t apply, you can overpay as much as you like.

If your interest is calculated daily, you’ll be charged interest for the number of days in each individual month. This means you’ll be charged more interest in January, which has 31 days, than February, which has 28 days (or 29 in a leap year), for example.

For repayment mortgages, each monthly payment reduces the overall balance we use to calculate interest, so the amount of interest added to the balance will also reduce.

Your mortgage balance might increase for many reasons, including:

You can do this:

By writing to:

Halifax

PO Box 54

Leeds

LS1 1WU

At your nearest branch

When you visit, you’ll need to have the original version of your name change document, such as your Marriage Certificate or Deed Poll, with you.

You can also complete and print the form you’ll need online:

Sign in to Online Banking, then select:

To add or remove a name on your mortgage account, you’ll have to apply for a remortgage in the names of the new property owners.

You’ll need to call us, so we can do some affordability and eligibility checks and recommend the right mortgage product for you.

You might be charged fees for a new loan. You’ll also need a conveyancer.

You can do this online:

Sign in to Online Banking on our app, then select:

You’ll need to tell us why the change is needed.

Or by writing to:

Chief Office

Barnett Way

Gloucester

GL4 3RL

You’ll need to send us a letter, signed by everyone named on the mortgage, telling us why the change is needed.

You can also change your address at your nearest branch, or call us if you prefer.