Go paper-free

Amend paper-free preferences for your statements and communications.

Buying a home for the first time can be exciting. But there’s also a lot to think about, from saving up for a deposit, to finding the right mortgage for you.

Read the step-by-step guide to buying your first home.

A mortgage is a loan taken out to help you buy a home. Most mortgages last between 20 to 30 years, but the term can be longer or shorter. You’ll make monthly repayments throughout this term, including interest on the loan.

The loan is tied to your home, until you pay it off. This means if you don’t make your repayments, the lender could take back – or ‘repossess’ your home and sell it.

You might come across the term first time buyer mortgage, or FTB mortgage. This is how we talk about mortgages for people who are buying a home for the first time.

There are also some government mortgage schemes that are specifically for first time buyers. For example, the mortgage guarantee scheme may allow you to apply for a mortgage with a 5% deposit.

If you’re applying for a mortgage, one of the first things to consider is the mortgage term. Essentially, a mortgage term is the length of time you have to repay the loan. The average mortgage ranges from 20 to 30 years, but the exact length of time can vary.

Usually, the longer your term, the lower your monthly repayments may be. But you’ll be charged interest on your monthly repayments. So, the longer your term, the more interest you could end up paying over time.

When you apply for a mortgage, it’s important to choose a term that works for you and your needs.

Getting on the property ladder can be tricky, especially if it’s your first time buying a house. But there are several government schemes that can help you buy your first home. These include:

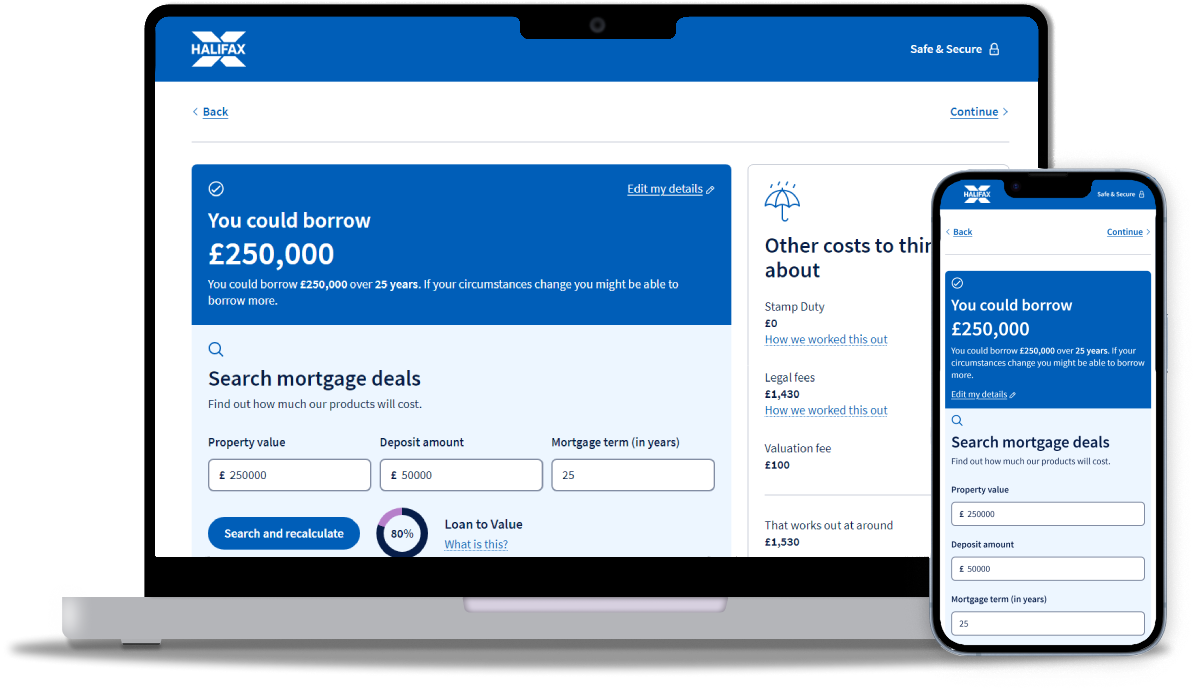

It's a good idea to work out what you can afford, and get an idea of how much a mortgage lender is willing to let you borrow. That way, when you come to make a full mortgage application your lender will know what your budget is and can help you choose the right deal.

When you have your agreement in principle, you can start looking for your dream home.

If you’ve not already got a mortgage agreement in principle, or you applied for one over 90 days ago, you’ll need to apply for another one. You’ll also need to get an AIP from the same lender you’re applying for a mortgage with.

To apply for a mortgage, get all your documents together, ready for your lender to look at.

You’ll need:

If you’re self-employed you’ll need a few more things.

At this point, you can get help from a mortgage and protection adviser. They can help you find the right deal for your budget and handle your application after you’ve made an offer.

When you take out a mortgage, your lender will need a surveyor to inspect and value the home you're buying.

For more information on valuation schemes and their costs, talk to your mortgage adviser.

Exchanging contracts is one of the final stages of buying your first home. It's a simple process where you basically sign a contract saying you agree to buy the house.

The seller also signs a contract saying they agree to sell the house. These contracts are then exchanged between the legal representatives on both sides, and you are legally obliged to buy the property.

When you start paying back your mortgage, your repayments will often come out automatically by Direct Debit. But you might be able to change how and when you pay online.

Your first payment could be a little higher than your normal monthly repayments. This is because your first mortgage payment includes an initial interest payment, on top of your monthly repayment. This covers the interest for the days between moving in and your first payment.

So, what might this look like? Say you complete your move on the 15th. Interest will be charged from then until the end of the month, and this will then be added to your first mortgage repayment.

You’ll normally make your first payment on the day of the month of your choosing. If your first payment is taken on a different date than the one you’ve chosen, it will be taken on the agreed date next month.

You can only get a buy to let mortgage if you’re buying a property and applying for a mortgage with someone who is not a first time buyer.

Solicitor or conveyancer fees are usually around £2,239 for buying a house. This includes things like the legal fee, conveyancing disbursements and any extra fees.

In England, first time buyers don’t pay stamp duty on the first £425,000 of a home’s value, and 5% on any value between £425,000 and £625,000. If you’re buying your first house alone, and you’ve never owned a property or land before, you’ll be classed as a first time buyer. If you’re buying property with your partner, both of you will need to be first time buyers to qualify, otherwise you may have to pay Stamp Duty at the normal rate. The rules are different in Scotland and Wales.